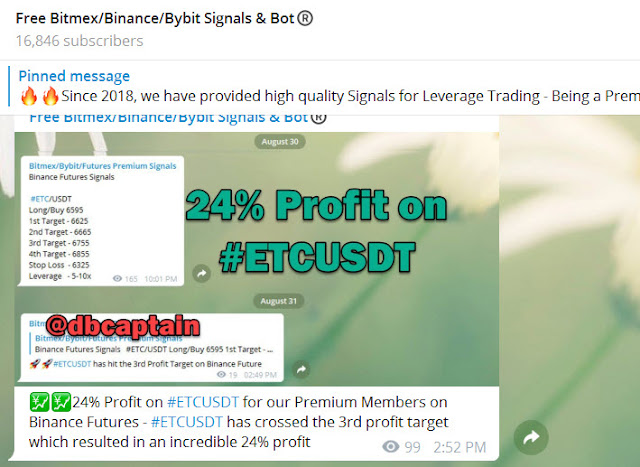

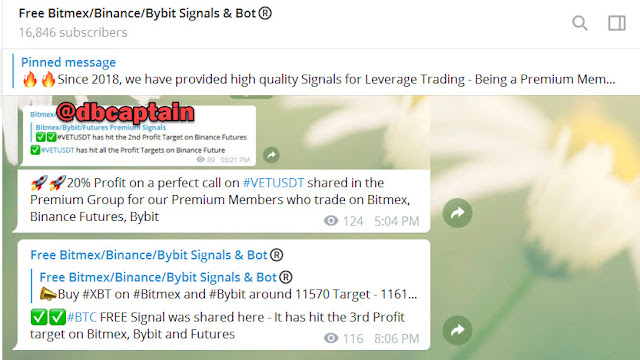

Visit - https://t.me/freebitmexsignals

For more latest update on Cryptocurrency, Free Bitmex ByBit Binance future signals with 80-90% accuracy & BitMEX ByBit trading BOT which does trades automatically in your account join above given Telegram group

Singapore Exchange has never listed Bitcoin and Ethereum indices before.

In brief

Singapore's stock exchange is listing crypto indices.

It's the first time it's done so.

The indices could be used by institutions creating complex financial instruments.

As Singapore mulls over cryptocurrency regulation, Singapore’s stock exchange today announced the listing of its first-ever cryptocurrency indices.

Per a partnership with CryptoCompare, a UK-based cryptocurrency benchmarking site, Singapore Exchange (SGX) is listing two crypto indices through its four-year-old SGX iEdge index suite: the iEdge Bitcoin Index and the iEdge Ethereum Index.

The indices track the prices of the cryptocurrencies. The listing on Singapore’s stock exchange makes it easier for investors to keep tabs on the prices of Bitcoin and Ethereum, which rank first and second by market capitalization, respectively.

Crypto indices are not crypto exchange-traded funds, or ETFs. Whereas an index tracks a selection of assets, ETFs allow investors to buy shares in a stock that mirror the price of the underlying asset, like Bitcoin.

If a Singaporean business wants to create a product or investment vehicle around Bitcoin or Ethereum, the indices would help verify the price. One reason why you might not rely on publicly available sites like CoinMarketCap for such data is that CryptoCompare’s index is vetted by regulators. The resultant precision is important for high-volume traders.

“As the world moves swiftly towards digitalisation in the creation and accumulation of wealth, digital assets are increasingly being adopted by investors,” said Simon Karaban, Head of Index Services at SGX, in a statement.

Although the indices are moving forward, Singapore’s central bank and financial regulator, the Monetary Authority of Singapore, is still working out how to regulate cryptocurrency.

In early 2020, it enacted a policy requiring crypto exchanges to obtain a license, though in March let some cryptocurrency companies, among them Binance, Coinbase and Gemini, operate in the country for six months without them.

The point is: Crypto’s place in Singapore is very much a work in progress. But SGX’s new indices could help financial institutions build crypto products when the dust settles.

According to TradingHours.com, Singapore Exchange has a market cap of $585 billion, far less than the Tokyo Stock Exchange’s $5.66 trillion market cap or Shanghai’s $5.26 trillion, let alone the New York Stock Exchange’s $21 trillion.

CryptoCompare’s crypto indices appear on other stock exchanges. In 2017, the Stuttgart Stock Exchange started listing 10 indices, among them those for Ripple, IOTA, ZCash, and Monero.

And in January 2020, CryptoCompare worked with Japan’s oldest brokerage firm, Nomura, quantitative analysis company Intelligence Unit, and index provider MV Index Solutions to get the NRI/IU Crypto-Asset Index off the ground.