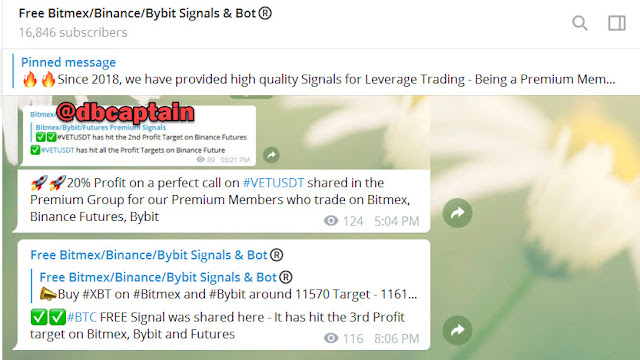

Visit - https://t.me/freebitmexsignals

For more latest update on Cryptocurrency, Free Bitmex ByBit Binance future signals with 80-90% accuracy & BitMEX ByBit trading BOT which does trades automatically in your account join above given Telegram group

Seven Wall Street companies gained nearly $300 billion in a day in total market cap – almost as much as the entire cryptocurrency market is worth.

Seven US-based giant companies, namely Facebook Inc, Apple Inc, Amazon.com Inc, Microsoft Corp, Alphabet Inc, Tesla Inc, and Salesforce.com Inc, gained nearly $300 billion in total market cap during yesterday’s trading session on Wall Street.

This only goes to show how small the digital asset field is compared to the giants, as their one-day combined gains represent almost the entire crypto market cap.

$282B Gained In A Day By 7 US Companies

Green dominated most tech-oriented stocks on Wall Street yesterday. Facebook’s shares (FB) exploded by over 8% to a new all-time high of over $300. The company’s total market cap increased by nearly $66 billion in just a day.

Apple’s stocks (AAPL) jumped by 1.36%, and one AAPL is more than $500. Apple’s TMC conquered the $2 trillion mark last week, and it has continued growing since then. Just during yesterday’s session, it went from $2,135 trillion to $2,164 trillion (gains worth $28 billion.) Interestingly, Apple’s market cap is larger than the GDP of countries such as Brazil, Canada, and Russia.

Amazon.com CEO Jeff Bezos became the first person ever to be worth over $200 billion after his company’s stocks (AMZN) soared by almost 3% to $3,442. Amazon’s TMC grew by $48 billion from $1,676 trillion to $1,724 trillion in a day.

Alphabet Inc, Google’s parent company, saw its market cap increase by $30 billion from $1,094 trillion to $1,124 trillion. The one-day TMC growth of Microsoft equaled $36 billion, Elon Musk’s Tesla’s – $24 billion, and Salesforce – over $50 billion.

As a result, all seven companies had their combined total market cap increase by roughly $282 billion.

The Crypto Market: How Small And Early It Really Is?

Outsiders of the cryptocurrency space often wonder if they have missed the train as Bitcoin’s price is in the five-digit territory, and it used to trade for much less just a few years ago. Other cryptocurrencies have also surged in value since inception, so investors worry that if it isn’t too late to enter.

However, by merely comparing the entire digital asset market with the information above, it’s easy to see that it may not be late to join the party. After all, the entire cryptocurrency market is worth about $355 billion at the time of this writing – slightly more than the gains marked by only seven companies in just one day.

Moreover, the cryptocurrency TMC was less than $280 billion in mid-July. In fact, even if we examine the top reached during the parabolic price increase in 2017/2018 of $830 billion, it’s still worth less than the market cap of Facebook and almost three times less than Apple’s.

Some may argue that most of these companies have been around for much longer than Bitcoin. However, while this is true for names like Microsoft (founded in 1975) and Apple (1976), it’s not entirely accurate for others such as Facebook (2004) and Tesla (2003).

Ultimately, this could showcase that although the cryptocurrency market contains thousands of digital assets, it’s still very early in its adoption cycle compared to the traditional financial field.