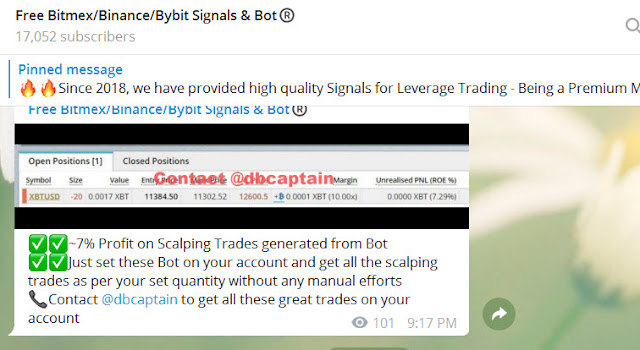

Visit - https://t.me/freebitmexsignals

For more latest update on Cryptocurrency, Free Bitmex ByBit Binance future signals with 80-90% accuracy & BitMEX ByBit trading BOT which does trades automatically in your account join above given Telegram group

Technology stocks in the US, which include some crypto and blockchain firms, are now valued higher than the entirety of the European equity market.

In brief

American tech stocks are now valued higher than the European stock market, including the UK.

Observers said investors rushed to tech investments as the sector was relatively sheltered from the financial impact of social distancing.

Prices of Bitcoin and other cryptocurrencies have grown in tandem as well.

US technology stocks now have a higher valuation than all of Europe’s equity markets, according to a report on markets outlet Business Insider. Cryptocurrencies and blockchain technology play a vital part in propping up the US tech stocks.

Tech stocks' market cap totaled $9.1 trillion as of Thursday, Bank of America executives reportedly told clients. The figures meant the sector's stocks have, for the first time, eclipsed equity markets in all of Europe.

Investors largely shifted their capital into tech players at the start of the ongoing coronavirus pandemic in March 2020 based on the sector’s large cash piles and insulation from lockdowns, the report said.

Heading the list are the so-called FAANG tech darlings: Facebook, Amazon, Apple, Netflix, and Google (now restructured as Alphabet). They account for a collective $7.5 trillion of the tech sector’s total valuation; Apple alone is worth $2.1 trillion as of August 28, while Amazon is valued at over $1.7 trillion.

Many large companies in the US stock market also build on blockchain. Nvidia, which sells its graphics cards to crypto miners, has a market cap of $324 billion. IBM, which builds blockchain products, among them a blockchain-based supply chain system used by Walmart, has a market cap of $111 billion. J.P. Morgan, which creates the Quorum blockchain network, has a market cap of $313.2 billion.

Companies exclusively devoted to crypto have, so far, remained a humble player in the broader US stock market. As per equity data site Barcharts, these include mining companies like Riot Blockchain, and Hut 8 Mining, with market caps of $170 million and $104 million respectively, crypto advisory firms like Blockchain Inc, and the Grayscale Bitcoin Trust, which is currently worth $2.3 billion.

However, firms like Coinbase, a regulated crypto exchange based in San Francisco, aim to change that. The firm reportedly made plans for an initial public offering earlier this year. Insiders tout an $8 billion valuation for its business—based on the SEC’s approval, according to Reuters.

However, while the blockchain, crypto mining, and tech firms are enjoying a moment in the US markets, the country’s financial giants have faced the ill-effects of an economic downturn. ForexSchoolOnline found that of all US banks, JP Morgan Chase decreased in value the most—the bank’s market capitalization plunged by $142.6 billion between December 2019 and July this year.

The rise in the valuation of tech stocks coincides with Bitcoin’s price increase this year. The pioneer crypto asset has risen over 60% since March 2020. It trades at $11,500 as of August 29.