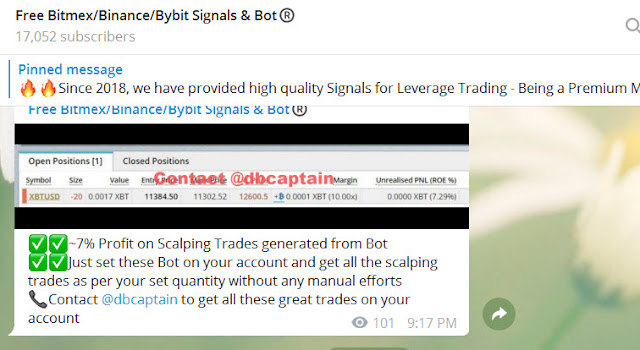

Visit - https://t.me/freebitmexsignals

For more latest update on Cryptocurrency, Free Bitmex signals with 80-90% accuracy & BitMEX ByBit trading BOT which does trades automatically in your account join above given Telegram group

One of the major points of contention when entering the cryptocurrency industry either as a trader or a HODLer is the security of digital assets. Many investors are on the fence when it comes to participating in this budding industry just because of the infamous incidents of hacks and cyber-attacks on crypto exchange platforms that have swindled investors to the tune of millions of dollars. As a measure to safeguard their investments, seasoned investors store their digital assets only on the most trusted and reputable crypto wallets.

In this article, we look at four of the most trustworthy and secure crypto wallets in the market today – CryptX, Ledger, Bitamp, and Electrum.

Differentiation Between Hot Wallets and Cold Wallets

Before we delve deeper into the aforementioned cryptocurrency wallets, it’s important to know about the different kinds of cryptocurrency wallets.

Primarily, cryptocurrency wallets can be divided between hot wallets and cold wallets.

What Are Hot Wallets?

Hot wallets, as the name suggests, are digital wallets that are connected to the Internet. Due to their online nature, hot wallets enable rapid access to digital assets. There is no dearth of secure hot wallets in the industry, with some of the most popular of them being MyCelium, Bread, Edge, Bitamp, and Electrum, among others.

Hot Wallets are optimal for those who require ‘on-the-go’ access to their digital assets for quick trades. As the price movement in the cryptocurrency industry is notoriously volatile, having or not having quick access to crypto investments can make or break the game for investors. Therefore, if you’re a trader or even just want to HODL cryptocurrencies for the long-term, you can bet your money on hot wallets. Investors can add an extra layer of security to their wallets by enabling PIN password and two-factor authorization.

What Are Cold Wallets?

As the name might suggest, cold wallets are ‘cold’ in the sense that they’re disconnected from the Internet. Cold wallets from companies such as Ledger and Trezor are becoming increasingly popular among novice and veteran investors alike courtesy of their unparalleled security.

However, due to their offline nature, they might not be the ideal choice for investors who are actively trading cryptocurrencies to make profits. Despite that, the stellar security provided by cold wallets makes them an ideal choice for those who want to store large amounts of crypto assets for the long-term.

Some of the Top Cryptocurrency Wallets

CryptX

Dubbed the “Swiss Bank for Digital Coins,” CryptX is a leading cryptocurrency wallet that offers its users enterprise custodial services with institutional-grade security. It is fast and easy to onboard.

(Source: CryptX)

With an intuitive and sleek user-interface, CryptX provides the simplest and most convenient way of sending, receiving, and managing crypto assets at minimal fees. The wallet secures users’ private keys in the impenetrable Swiss bank-grade Hardware Security Modules (HSM) that are developed, manufactured, and programmed in Switzerland. This, in essence, means that CryptX users can rest assured that no one is gaining unauthorized access to their private keys.

CryptX cryptocurrency wallet supports a wide array of digital assets and regularly introduces support for new ones, thereby eliminating the need for individuals to maintain multiple crypto wallets.

At present, CryptX can be used to manage more than 100 cryptocurrencies including top digital assets such as Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Tether (USDT), and Chainlink (LINK), among several others. CryptX also supports other crypto-specific events such as forks, and token airdrops so that users do not have to shuffle and move their digital assets to other wallets.

All secure information related to accessing the cryptocurrencies supported by CryptX are stored in Swiss HSM devices which can be managed through the wallet’s secure APIs via Two-Factor Authentication. In addition, CryptX also leverages several other robust security mechanisms such as wallet freezing, and address whitelisting.

CryptX provides its users with cutting-edge trading features.

For instance, consider the CryptX Auto Swap functionality that automatically swaps BTC, ETH, BCH, LTC, and USDT within the user’s wallet to eliminate exchange rate risk involved in cryptocurrency operations. In simpler terms, the Auto Swap feature ensures that users do not lose their investments on volatility. Users can tap this feature to safeguard their digital assets from undesirable price swings.

Last but not the least, CryptX is cognizant of how big a pain enormous transaction fees can be for users. In that regard, CryptX offers SegWit, transaction batching, and other fee management tools to ensure its users have minimal exposure to unnecessary expenses.

Interested individuals can book a CryptX wallet Demo on their official website here.

Ledger

Ledger is a leading hardware or cold wallet firm based out of France. Ledger’s two flagship products – Ledger Nano S and Ledger Nano X, are often considered the industry-benchmark for hardware wallets because of their robust and cutting-edge security mechanism.

Ledger Nano S supports a swathe of cryptocurrencies, including some of the most popular digital assets, such as Bitcoin (BTC), Ether (ETH), XRP, Litecoin (LTC), and Bitcoin Cash (BCH), among others.

Bitamp

A leading Bitcoin (BTC) wallet, Bitamp is a trusted name in the cryptocurrency wallet space. Bitamp is an open-source, client-side, Bitcoin wallet that enables users to seamlessly send and receive the premier cryptocurrency from anywhere in the world.

The wallet keeps user privacy at its core and requires no user information at all. Users are not required to share their email addresses or any other personal information to enjoy the benefits of this free Bitcoin wallet. Bitmain strives to preserve user’s anonymity and, in that regard, never stores the seed phrase, private key, IP address, or user browser details.

Electrum

One of the oldest digital wallets in the industry, Electrum has successfully maintained its reputation throughout the years.

Electrum is a desktop Bitcoin wallet compatible with various operating platforms such as Windows, Mac, and Linux. Because it’s an open-source wallet, Electrum has continually undergone important additions from the best programmers and security enthusiasts in the crypto space. The continual refinement has cemented Electrum as one of the most respected Bitcoin wallets in existence today. Just like Bitamp, Electrum can also be integrated with several leading hardware wallets including Ledger, Trezor, and others.